Unlocking Your Wealth Potential

Financial freedom is the state of being in complete control of your finances, where you have enough money and resources to live the life you desire. It means having the freedom to make choices without being limited by financial constraints or worries. It’s about being able to comfortably cover your expenses, save for the future, and pursue your dreams and goals without stress. Financial freedom allows you to have peace of mind and the ability to create a secure and fulfilling life for yourself and your loved ones.

When it comes to achieving financial freedom, it’s not always about earning more—it’s about managing what you have effectively. If you’re searching for simple and actionable ways to improve your financial health, you’ve come to the right place. This post will guide you through 10 simple best practices that you can apply to start your journey towards financial independence.

Do you dream about the day when money worries become a thing of the past? Financial freedom, the point where your assets generate enough income to cover your living expenses, is not a distant dream. It’s achievable, and you don’t have to be a finance connoisseur to get there.

We have been changing our mindset to this way of thinking and implementing these steps and the results are showing little by little…Lets goooo 🙂

Here, the 10 best simple practices to achieve Financial Freedom 🙂

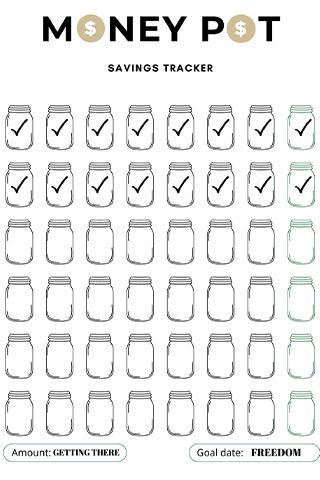

1. Set Clear Financial Goals

You cannot reach a destination if you don’t know where you’re heading. Similarly, achieving financial freedom requires clear, well-defined goals. Perhaps you’re dreaming of owning a home, starting a business, or retiring early. Whatever your financial aspirations are, write them down and create a plan to achieve them. Remember, goals should be SMART – Specific, Measurable, Achievable, Relevant, and Time-bound.

2. Create a Budget and Stick to It

Crafting a budget is one of the simplest and most effective ways to control your finances. It enables you to understand where your money goes and helps you prioritize your spending. A budget is not about restriction, but about making conscious choices with your money. Once your budget is in place, the trick is sticking to it. Apps like Mint or You Need A Budget (YNAB) can simplify this process.

3. Save Before You Spend

An easy way to ensure you’re always saving is to pay yourself first. Before paying bills or making purchases, set aside a portion of your income for savings. This simple practice makes you prioritize saving over spending. Direct depositing a percentage of your salary into a savings or investment account can help automate this process.

4. Build an Emergency Fund

Unexpected expenses like car repairs or medical bills can derail your financial goals. To avoid this, establish an emergency fund with at least 3-6 months’ worth of living expenses. This safety net offers peace of mind and the financial stability to handle life’s unpredictable moments.

5. Be Debt Smart

Not all debt is bad, but high-interest debt like credit card debt can be a barrier to financial freedom. Make a plan to pay off these debts as quickly as possible. Once cleared, avoid unnecessary debt by living within your means.

6. Make Your Money Work for You

Investing is a powerful tool that can help you grow your wealth over time. Even if you’re a beginner, there are plenty of resources and platforms that make investing accessible. Start small and gradually increase your investments. Remember, investing involves risk, so always do your research or consider consulting with a financial advisor.

7. Understand Your Taxes

Taxes can take a big bite out of your income and investments, so it’s essential to understand them. Tax-efficient investing and taking advantage of tax deductions can save you a significant amount of money over time. Consider consulting a tax professional to optimize your tax strategies.

8. Protect Your Wealth with Insurance

Insurance is a key part of any financial plan. It protects your wealth from potential risks such as illness, disability, and property damage. While it might seem like an unnecessary expense when times are good, you’ll be glad you have it when you need it most.

9. Regularly Review Your Finances

Like a health check-up, regular financial reviews are important to ensure you’re on track to achieve your goals. This allows you to adjust your budget, reassess your investments, and make sure your insurance coverage still meets your needs.

10. Continue Learning and Improving

The journey to financial freedom is a lifelong learning process. Keep abreast of financial news, read personal finance books, take online courses, or consult with financial advisors. The more you learn, the more equipped you’ll be to make informed financial decisions.

Financial freedom isn’t about being rich. It’s about having control over your finances and living without financial stress. It might seem a daunting task, especially if you’re starting from scratch, but every journey begins with a single step.

In conclusion

Financial freedom is a journey, not a destination. Continue educating yourself about personal finance and seeking ways to improve your financial habits. Knowledge is power, and the more you know, the better decisions you’ll make.

Start implementing these practices today and watch as your financial life transforms, moving you closer to the day where money serves you, not the other way around.

By following these 10 best practices, you can start taking control of your financial future. The road to financial freedom may not always be easy, but with patience, persistence, and good financial habits, it is undoubtedly achievable.

In the meantime, check our blogpost: “The Ultimate Mediterranean Getaway: Exploring the amazing Santorini, Barcelona, Amalfi Coast, Dubrovnik, and the French Riviera“, so when you are financially free, you will know where to go to celebrate 🙂

Do you have any other relevant tips that can help with financial freedom? If you do, please let us know down in the comment section so we can incorporate them to our list of practices 🙂

Comments +